I am trying to write a series of expert essays on 10X innovation that creates big businesses. In my quest to write this, I have discovered some good blogs. One of which is Jerry Neumann’s blog, reactionwheel.net.

The blog posts that have been critical to my essay are the 4 below. I am going to summarize the best lessons from the post, but I will be leaving out a lot of technical details, so I suggest you read them in the order listed if you want to get the full gist.

Managing Technological Innovation

iTunes and the Basis of Competition in the MP3 Player Market

iTunes Case: Technological Innovation

There are 2 kinds of businesses/founders

1. Businesses that replace the current job of the founder.

These businesses are not built for growth or innovation and often compete in a crowded market. Founders of this business end up making just as much money as they would have made in a regular job.

This graph from the book, Illusions of entrepreneurship,

2. Businesses that make entrepreneurial profit

It is worth noting that innovation is not sustainable competitive advantage and the most innovative businesses will be copied and competed with at some point. The best businesses making entrepreneurial profit know this and try to increase their defensibility through innovations that deliver defensible moats across scale, brand, embeds, and network effects.

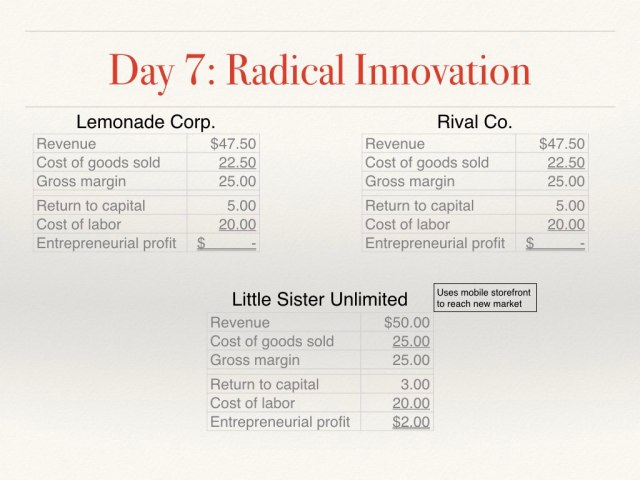

In the chart, the graph on the left is the first kind of business. Notice that there is no profit because all the profit are used to service the inputs of the business including the founder’s salary (the founder is a business input). Profits in these kinds of businesses are within the industry average and as competition

The graphs in the right show 2 types of entrepreneurial profit.

- Profits achieved through cost leadership that arises from process innovation.

- Profits achieved through differentiation that arises from product innovation.

To demonstrate how innovation works, we will use improvements in glass production technology. The graph below highlights the difference between Product innovation aka radical innovation aka 10X innovation, and process innovation aka incremental/sustaining innovation. Product innovation is a leap in technology while process innovation

It is worth repeating that product innovation does not equate sustainable competitive advantage which is why businesses making entrepreneurial profits can stop making those profits overnight. In the graph below, a company goes from making no profits, innovates their business, makes entrepreneurial profits until the competition catches up with them, and they are back to making no profits.

Bringing this into

Cost leadership: If you can bring down the costs of your input significantly below your competitor through process innovation, you will make good profits. However, your competitors might quickly realize what you are doing and copy it. Example: American companies moving their call center and manufacturing to low wage countries. An entrepreneur started it and others followed.

Amazon got big on cost leadership and was able to achieve the defensible moats of scale and brand before their competitors caught up to them.

Differentiation: You introduce a product for an underserved audience that your competitors do not cater too through product innovation. Example: Instagram vendors appeal to an audience that wants to buy online Vs. sellers in Lagos Island market.

Differentiation will be copied as soon as your competitors see you grow fast. Example: Facebook and Instagram copying Snapchats story feature.

Focus: If you focus on a certain market segment or product, you will unlock either cost leadership or differentiation through speed and doing hard things to gain authority and techniques. My favorite example of this is Amazon. Jeff Bezos summarized this idea in the pithy statement, “Your margin is my opportunity.“ A maniacal focus on delivering the best shopping experience to the consumer differentiated Amazon and created cost leadership in the market.

To illustrate the best ideas above, consider the next couple of screenshots shared by Jon Neumann in his class.

Lemonade Corp sees an opportunity to make good lemonade and decides to start a business.

On day 1 Lemonade Corp, makes a nice profit.

By Day 2, competition enters the market because they see the entrepreneurial profits Lemonade Corp is making, and all the profits get eroded.

On day 3, Lemonade Corp innovates their processes and achieves cost leadership

Rival Corp is quick to copy this process innovation and achieves the same profits

To boost market share, Rival Co crashes their prices on Day 5 which is not good for Lemonade Corp

To stay competitive and win back its market share, Lemonade Corp matches the crashed price on day 6.

On Day 7, a new entrant enters the market that differentiates itself by market segment and unlocks a new market that neither Lemonade Corp or Rival Co could reach.

Clearly, the real world is more complex than this, but the lessons and observations are true.

If you look at the headlines often enough, you will observe this story play over and over again. And if competitors do not copy companies with product innovation early (Facebook copied Snapchat early), the company can quickly build new moats that make their business more defensible. Example: Amazon AWS had a 7-year gap before competitors came after its market share and it is a more defensible business than many cloud service provider just as a large Instagram following and website is more defensible than a stall in Lagos Island market.

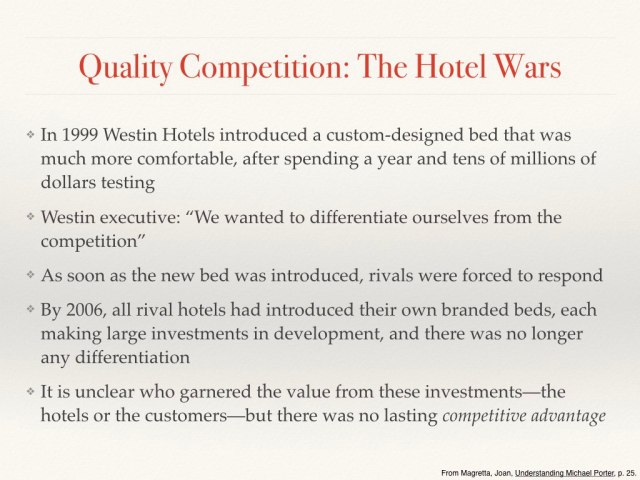

Entrepreneurial profits do not last long because of competition. Unfortunately, most direct competition is done in very unhealthy ways that benefit only the customers. See the case of Westin hotels.

If you are going to compete, you need to be looking at sustainable competitive advantages through economies of scale, brand, expertise, embeds, network effects, or any other moat you can create.

If you liked this. please read my post on cost disease.

Every image asset used was from Jon’s blog. And 90% of all good ideas are his.

If you like my content, I run a newsletter where I share my raw ideas and solicit feedback from my subscribers. I encourage you to subscribe. If you do not like my content, still subscribe so that you can give feedback and help me become better. I cover ideas on decision making, strategy, the way the world works, marketing operations, business operations, and experiments with my life.

Sign up here: https://yemijohnson.substack.com/p/coming-soon

If you want to work with me, click here.