I’ve spent the last 2 years thinking a lot about consumer health insurance while building a consumer health insurance business, getting acqui-hired, and serving as Senior Vice President of Consumer Business at Reliance Health.

This essay illustrates how the biggest industries in healthcare make money and how new upstarts can make entrepreneurial profits.

But first, let’s talk about the law of conservation of attractive profits by Prof. Clay Christenson.

The law of conservation of attractive profits states that in the value chain there is a requisite juxtaposition of modular and interdependent architectures, and of reciprocal processes of commoditization and decommoditization, that exist in order to optimize the performance of what is not good enough. The law states that when modularity and commoditization cause attractive profits to disappear at one stage in the value chain, the opportunity to earn attractive profits with proprietary products will usually emerge at an adjacent stage.

💡 The terms modularity and commoditization will be used a lot in this essay, so it’s important that I define them.

💡 Modularity means that a component in a business’ product value chain isn’t proprietary to the business/product. Instead, the component is created by a 3rd party who’s able to innovate and make the component to very high standards that it makes no sense for businesses that need that component in their product to make it themselves. Example: Most smartphone manufacturers do not make their own phone screens instead they buy them from a supplier, hence phone screens are modular components.

💡 Commoditization means that the profits in one of the components that make up the product’s value are driven to zero. This often happens because of competition and innovation. When a company commoditizes a component, the expectation is that they’ll unlock value in a different part of the value chain. Example: MTN, the African telecoms giant, started by selling SIM cards for ~$200. When the competition came in, they crashed the price to ~$5 thereby making SIM cards a commodity. The profits they were making on SIM card sales disappeared overnight however this meant they could mass-acquire customers and make the profits on the actual utility of a SIM card (making calls).

Back to Prof. Clay Christenson’s quote. A simple translation of his quote is that a new business can find a way to make the profits disappear from one part of the business value chain by commoditizing a layer of service or component and make the profits re-appear at another part of the value chain by integrating new service layers or components.

A very good example is online travel agencies (OTAs) vs hoteliers and commercial airlines. If you tried picking a place to stay in a new city without an OTA (Ex: Booking.com), you would be constrained by how many properties you can check out since one of the most important things when making a decision on where to stay is trust – trust that the property is good – you would select a property based on their brand because brand is a proxy for trust.

OTAs make it possible for you to view every property (pictures, reviews, descriptions) in any location hence commoditizing the properties’ brand because the thing you’re looking for (trusted accommodation experiences) is no longer dependent on the property’s brand as the OTA gives you enough information to make the purchase decision. The OTA commoditized all properties and eroded the profits a property would have extracted through the brand they have built while the OTA extracts value from the customer by enabling reservations. Since the OTA collects the money by enabling reservations, they can ask the hotels to give them a commission if they want the guest to stay. You can apply the same value chain disruption to the airline industry vs OTAs too.

The left shows the value chain for hoteliers while the right shows the value chain for OTAs

This is why Booking.com or any hotel booking marketplace can quickly try to replicate Airbnb’s business, but big chain hoteliers like Marriot and Holiday Inn cannot do that because their business value chain is very different. This means that the OTAs are counter-positioned to the hoteliers.

A layer being modular means that any player can integrate that layer into their value chain easily, however, profits are stripped away when the layer becomes commoditized while value capture happens on the integrated level. If a layer in the value chain becomes commoditized, then the economic opportunity of capturing value on that layer goes to zero, especially if the innovation that made this new business model possible is disruptive. Read my essay on how businesses make entrepreneurial profits to see how profits go to zero.

The value chain for people looking to access care looks like this:

Hospitals and clinics integrate the facility and trusted care into one service and market it to consumers of healthcare, so you end up picking a facility based on the brand around trusted care that they have built. The payment/billing layer is modularized which means they do not have a direct financial relationship with healthcare consumers, hence the profit opportunities they can pursue are constrained by their integration & value capture layer.

The hospitals make their margin from bundling trusted care and the facility together. This is why the rates at each hospital are different and consumers of healthcare make their decision based on how much they trust a health provider not necessarily on price because trust is more important. A hospital can decide to integrate the billing layer into their trusted care + facility layer by charging a membership fee that gives access to all care you need, but because care is not commoditized this value chain restructure will break (no profits to extract) because you need scale economies to extract value from commoditized layers.

Health insurance providers restructure the value chain to look like this

Health insurance providers integrate the payment method with trusted care. The facility becomes a commodity hence the health insurance provider isn’t trying to extract any value from the facility. Their intent is to pay the least amount of money to the healthcare facility so that they can extract more value from the Trusted care + Billing layer. What consumers of healthcare need is trusted care, and the health insurance provider has taken on the job of providing facilities you can access trusted care for free. It’s also in the best interest of the health insurance organization to only offer facilities that give trusted care because it’s cheaper for them (helps retention and reduces costs from patients having multiple encounters from bad care). This is why health insurance providers have teams whose objective is to eliminate fraud and unnecessary risk from healthcare facilities and other providers of healthcare.

By bundling the payment method with trusted care, health insurance providers are not constrained by the business model of only being able to offer in-person care like hospitals, they can offer more in their bundle of trusted care or sell you extra services like health financing for care that is not covered within your health insurance plan.

In this business model, the profits are not made from the facility and the facility becomes a commodity in the value chain where the prices are the same across all facilities to the health insurance organization. The trusted care + payment integration creates a bundle of several benefits to the consumer and the consumer’s affinity to pay for each of these services varies. A consumer wants dental care, but they feel there’s a low chance of them ever needing surgery, however, the consumer can do mental math and conclude that it’s cheaper to pay for the health insurance plan they select than it’s to pay out of pocket for every procedure they might need to undergo even though there’s a chance that they might only utilize care once. The insurance company makes its margin from the healthcare bundle it sells the consumer. It prices all the risk of providing care then sells you the bundle at a discount to the average amount an average consumer pays for healthcare in a period. So if the average person hospital-goer spends $100 per year on hospital visits, the health insurance company can sell everyone a plan for $80 and assume that not everyone that bought the plan would ever use it. The regular Joe already knows they spend $100 or more on their bad years so an $80 deal you might never use is better than paying >$100 in case you need to use healthcare.

What makes health insurance providers powerful is that they aggregate supply (healthcare providers) on one side and consumers of healthcare on the other side which means that if hospitals want access to healthcare consumers they need to go through health insurance providers, however health insurance companies fail to live up to the economics of a true aggregator like Booking.com or Airbnb because the cost of fulfilling the service has real-world components, which makes it hard for them to flex their strategic muscles (this muscle comes from re-organizing the healthcare value chain) because they are burdened with managing costs.

In the case of Booking.com, you go there because they have the supply you want (a hotel in the city center) and the hotel agrees to work with them because they have demand (lots of guests). The same thing happens for health insurance providers too. However, this is where the economics take a turn, Booking.com sells you a reservation at a hotel and keeps their commission (they pay zero transaction fees from that commission). It’s the hotel that has real-world costs. Health insurance providers have to pay an expensive transaction fee every time a customer utilizes the product, this fee is a variable cost, and minimizing this variable cost of the transaction requires a lot of managerial complexity in managing costs. This managerial complexity becomes a sunk cost in the organization which gets ingrained in the company’s operations, hence positioning health insurance providers in a tough place that makes it hard to react to new business models.

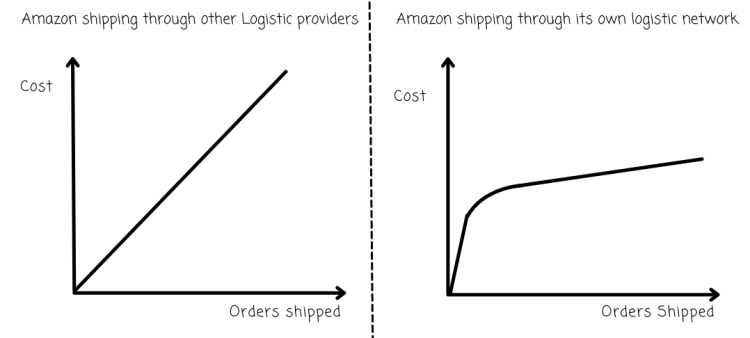

This is how managing cost can transform the business

The cost of care on the right rises very fast because of Capex costs, but once you break even on Capex the costs begin to flatline even as utilization increases. The graph on the right shows that there will always be a proportional increase in cost with every extra bit of utilization so if utilization should skyrocket, the pricing model will break.

The cost of care on the right rises very fast because of Capex costs, but once you break even on Capex the costs begin to flatline even as utilization increases. The graph on the right shows that there will always be a proportional increase in cost with every extra bit of utilization so if utilization should skyrocket, the pricing model will break.

The complexity of making that curve bend and flat line as utilization increases is hard. For instance, one way to manage costs is to invest more in CAPEX (capital expenditures). You can take a cost from the bundle, turn it into CAPEX and reduce the reliance on real-world fulfillment as possible. Example: replacing primary care consultations with telemedicine consultations.

Another example, howbeit expensive and hard to scale: if the providers in the health insurance organization’s network bill them $10 for a primary care medical consult, the health insurance company can invest in building their own health facilities in locations with a lot of their healthcare consumers, hence they can drive the price down to a fraction of $10 (maybe $6 per medical consult assuming the hospital makes a 40% margin).

This is the same business case Amazon most likely used to bootstrap their logistic business. Shipping is a variable cost – Amazon pays a relatively fixed fee per item shipped – that adds up to billions of USD every year. Let’s assume Amazon pays $8 per item shipped and they ship 2 billion items per year, that’s $16 Billion they are paying to other logistic providers. Also assuming that logistic providers are keeping $2 out of the $8 as profit, at that very high spend Amazon can turn that cost into Capex. We can assume the logistic providers make $2 as profit on every $8 spent to ship an item which means the cost to service each item shipped is $6. Amazon might be able to drive better efficiency since they are vertically integrating shipping into their business and the cost of shipping each item becomes $5 this means Amazon’s $16 billion in shipping costs can go further. Now that they’ve commoditized shipping within their business through vertical integration they can extract value from the demand side (buyer) through Amazon Prime and the supply side (sellers) through Amazon Seller Central and Fulfilled by Amazon.

It took a lot of managerial complexity to bend the cost curve and all of that complexity are sunk costs. If a new model of delivering physical goods came out today that was different from existing technologies of today, it might make it difficult for Amazon to compete because of their overinvestment in managing operational costs.

It takes a lot of business attention to bend a cost curve like this through Capex. Scaling these kinds of CAPEX puts any business in a place where they suffer from the managerial complexity of managing those costs. They eventually become sunk costs that the business has to live with because of the nature of their business.

Where are the opportunities for a new player

One of my best business quotes is by Jim Barksdale, former CEO of Netscape.

There are only two ways to make money in business: one is to bundle; the other is unbundle.

A good example to illustrate the quote above are banks and Fintechs. Banks bundle a lot of financial products (loans, savings, business banking, investments, et al). Many Fintechs unbundle the different offerings from banks and provide them as a standalone service so you have an app for loans, another app for savings, another app for fixed income investments, another app for stocks, et al. All your different apps provide a superior service to what your bank provides, but you would also notice that your Fintech apps are beginning to bundle services again as they get bigger.

The unbundling of Bank of America. All these Fintech players probably provide a superior service to what BoA can provide in its own bundle.

Any player bundling a bunch of services together means they are half-assing some of these services no matter how seemingly great they look on the outside. There’s always an opportunity for a player to gain market share when they whole-ass a service and focus on a differentiated product rather than a service/product that is heavily commoditized.

A hospital that provides multiple types of care will perform worse than a hospital treating a specific type of disease alone because it’s harder to innovate when you don’t have “focus” as your innovation strategy. The same thing happens in consumer technology where Notion is a better document editor than Google docs, or where Super Human is a better email provider than Gmail. The innovation strategy for Notion and Super Human is to focus on the job to be done whereas Google is attempting to bundle the entire work suite.

Now that you realize there’s always opportunity, you can decide to take one part of the value chain and break it down into its own value chain, then reorganize the steps. For instance, you can break down diabetes care (a sub-part of trusted care) as:

diabetes care + diabetes drugs + appointment/payment + healthcare consumer

Many pharmacies integrate some section of diabetes care + diabetes drugs as a way to add more margin to their business because people with diabetes are willing to pay for diabetes drugs even if they cost a lot.

You can re-organize this value chain so that you focus on the healthcare consumer (demand)

If you own demand (healthcare consumer), it means the cost of acquiring each new customer gets cheaper as you grow. It does not cost Google more money to acquire their n+1 user than it cost to acquire n+∞ user. You can acquire members by making your CAPEX free or self-sustaining especially if the transaction costs are marginal and tend to zero (zero operating costs). For instance: a community where the members share their healthcare experience and help other people to be more successful in taking care of their health has zero operating costs and as the community gets bigger you acquire more customers because the intent for joining the community is to manage bad health.

If you own the payment method via appointments, you can extract value through new business models. People with diabetes also need to see a specialist, they need to do advanced investigations, they need insurance cover for every other type of care, and they often will have other pre-existing conditions. The business you build on top of this is up to you, but you might want to read my essay on how businesses make entrepreneurial profits and listen to this podcast on 7 business powers by Jeff Lawson, Twillio’s CEO.